The crypto market is breathing easy, but short-term investors' $100,800 base is shaping the stage.

The cryptocurrency world is keeping its eyes on Bitcoin, and the latest on-chain and market data suggest the digital currency is in a phase of consolidation and equilibrium, far from unbridled euphoria or widespread panic. Key indicators point to a scenario of controlled optimism, laying the groundwork for future movements.

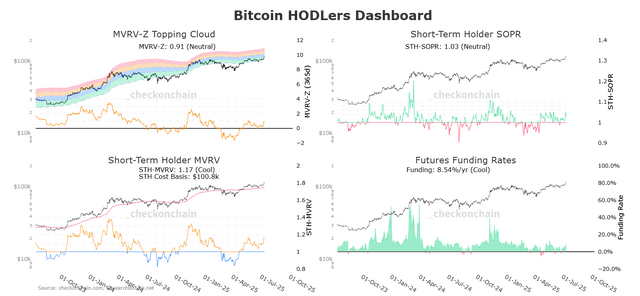

The interpretation of this data points to a period of sideways consolidation or, perhaps, a slight controlled uptrend in the short to medium term. CheckonChain

Market Snapshot: Indicators in Neutral-Cool Mode

Experts who thoroughly analyze Bitcoin's performance rely on sophisticated metrics. One of them is the MVRV-Z Topping Cloud, which currently stands at 0.91 (Neutral). This means Bitcoin is neither overvalued nor undervalued relative to its "fair value," indicating a calm market with no bubbles in sight.

Another relevant piece of data is the Short-Term Holder SOPR, which stands at 1.03 (Neutral). This figure reveals that investors who acquired their bitcoins less than 155 days ago are selling their assets at a slight profit. This represents healthy profit-taking, without the massive sell-offs that typically precede sharp declines.

In line with the above, the Short-Term Holder MVRV stands at 1.17 (Cool), indicating that these same investors are enjoying an average profit of 17% on their investment. Most interesting is its average cost basis: $100,800. This value is emerging as crucial psychological and technical support, an important barrier that, if broken downwards, could lead to selling by these holders.

Finally, the Futures Funding Rates are at 8.54% per year (Cool). This percentage, although positive, does not reflect excessive leverage in the futures market, which reduces the risk of cascading liquidations and suggests an appetite for long positions that is optimistic, but not unreasonable.

What to Expect? Consolidation and Opportunities

The interpretation of this data points to a period of sideways consolidation or, perhaps, a slight, controlled uptrend in the short to medium term. The absence of overheating or panic offers fertile ground.

It is possible that we are witnessing a reaccumulation phase, where institutional and large-cap investors are acquiring Bitcoin at current prices, preparing for the next major bullish move. However, current data does not confirm aggressive accumulation, suggesting a patient strategy on the part of these players.

Bitcoin is in a moment of cautious equilibrium. Technical and blockchain indicators reflect a mature, breathing market, far from extreme volatility. The ability of the leading cryptocurrency to hold support at $100,800 will be key to determining its future trajectory. This scenario offers an interesting playing field for those seeking investment opportunities or simply wanting to better understand the dynamics of blockchain and crypto trading.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency trading involves risk, and thorough research is recommended before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit