An outflow of nearly 1,000 BTC from the ultra-fast micropayment network is raising concerns, suggesting profit-taking and a possible shift in incentive dynamics.

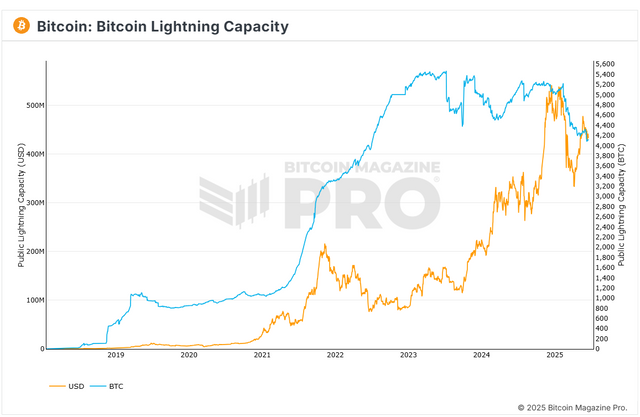

Bitcoin's Lightning Network (LN), the scalability layer designed for instant micropayments, is experiencing a significant reduction in its Bitcoin (BTC) capacity through 2025. According to data from Magazine Pro, the amount of BTC on the network fell from 5,051.46 BTC at the beginning of the year to just 4,124.18 BTC currently. This decrease, the first significant one since 2021, suggests that Bitcoin's recent price surge could be incentivizing node operators to take profits, impacting the liquidity of a network critical to mass adoption.

As Bitcoin prices fell between 2021 and 2023, Lightning Network capacity consolidated / Bitcoin Magazine Pro

The Reverse Flow: Why Is BTC Leaving the Lightning Network?

The Lightning Network is a second layer (Layer 2) built on top of the Bitcoin blockchain, designed to solve scalability challenges, especially in microtransactions. It works by creating two-way "payment channels" between users. Instead of recording each small transaction on the main Bitcoin blockchain (which would be slow and expensive), these transactions are made off-chain, within the LN channels, with only the final transaction closing the channel recorded on the blockchain. This allows for near-instant payments with extremely low fees, even as low as 1 satoshi. LN node operators are key to this system, as they keep the channels open and earn fees for facilitating transfers.

Since 2021, the Lightning Network had seen a steady accumulation of BTC in its capacity. In that year, the network hosted just over 1,000 BTC, a number that grew as more node operators joined and interest in micropayments increased. However, so far in 2025, this trend has reversed dramatically.

There are several reasons for BTC to exit the Lightning Network:

Profit-Taking from High Prices: The main incentive behind this recent reduction appears to be rising Bitcoin prices. When BTC's value rises significantly, some node operators may decide to liquidate part of their holdings on the LN channels to secure profits. Since holding BTC on the channels involves tying up capital, a higher price makes it more attractive to sell.

Capital Optimization: Node operators seek the highest profitability. If the fees earned from micropayments don't offset the opportunity cost of having BTC locked in the channels, or if they find more lucrative opportunities in other segments of the crypto market, they may withdraw their capital.

Node Rebalancing: Traders may be reevaluating their strategies and adjusting the amount of BTC they allocate to LN channels to optimize their liquidity or diversify their operations.

Flashback to 2022: Current Capacity Analysis

As Bitcoin prices fell between 2021 and 2023, the Lightning Network's capacity consolidated, accumulating a considerable amount of BTC. However, the recent outflow of coins has brought current capacity to lows not seen since July 2022.

Despite this contraction in total capacity, the motivation to operate nodes remains. Many operators continue to use the Lightning Network to handle micropayments and low-value transactions. This model remains an attractive incentive, allowing them to generate profit in the form of fees for facilitating these transactions, even though the overall scale of the network in terms of BTC locked has temporarily decreased.

The current dynamics of the Lightning Network reflect the interconnection between Bitcoin's value and the incentives to operate infrastructure on the second layer. While profit-taking is a natural factor in a bull market, continuous monitoring of this metric is crucial to assessing the long-term health and growth of Bitcoin's ultra-fast payment network.

Future of Micropayments

The reduction in Bitcoin's capacity on the Lightning Network is a phenomenon that deserves attention. While it may be a natural response to high BTC prices, allowing traders to take profits, it also raises questions about liquidity and the availability of micropayment channels in the future. As Bitcoin continues to solidify its position as a mainstream asset, the evolution of its scalability layer, such as the Lightning Network, will be a key indicator of its path to mass adoption.

Disclaimer: This article is for informational and journalistic purposes only and does not constitute financial advice or investment recommendations. The cryptocurrency market is highly volatile, and investments involve significant risks, including the possible total loss of principal. Readers are advised to conduct their own thorough research and consult a qualified financial professional before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit