Hi traders, It's Faran Nabeel, And I always hope that you're fine and enjoying the life with your family. As we know that scalping is a way to earn profit in very short time and trader can earn profit from short term trades with propper risk management.

Question 1: Understanding Scalping in Steem/USDT

Scalping is the short term trading strategy where trader make numerous quick some trades to profit from small price movement. The idea is capture for tiny gains repeatly rather than wait for large price shift. Scalper trader typically hold position for seconds and minutes, require that fast decision making, precise the timing, and low transaction cost. Unlike the day trading, where position can be hold for minutes to hours during the one trading session, onnthe other side, scalping focus on rapid entry and exit. Swing trading, involve hold position for several days and weeks to profit from larger market moves, make it the more patient and less frenetic approach.

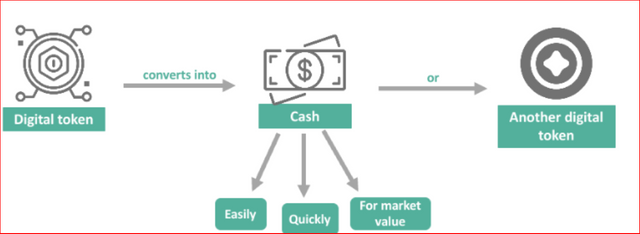

If I consider the STEEM/USDT pair for scalp trading, several factors are need to see. First, liquidity is important. A good scalp pair should have the enough trading volume to allow quick and fast entry and exit without cause the significant price slippage. If STEEM/USDT offer high liquidity and tight bid ask spread, it become more suitable for scalp trading since trader can execute multiple trades quickly and perfectly. On the other side, if liquidity of the trading pair is low and the spread is wide, scalping become highly challenging due to risk of slippage and unexpect price gaps.

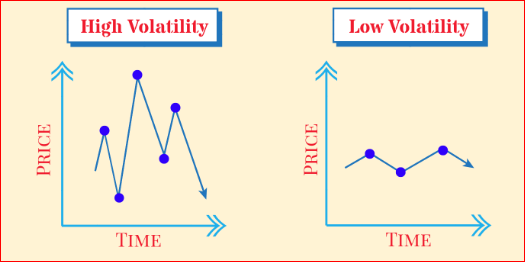

Another factor is volatility. Volatility is necessary to create profit opportunity, excessive volatility can be increase risk, especially in scalping environment where small loss can add up quickly. Understand the market behavior and timing of the market is essential. Transaction feeses and platform reliability play a significant role in determining whether STEEM/USDT is appropriate for scalping.

Scalping is all about the speed and small gains, different from day and swing trading according to the length of trade duration and risk management. Steem/USDT can be suitable for scalping if it continuously provide high liquidity, low spread, and manageable volatility, allows us to execute their strategy effectively.

Question 2: Best Indicators for Scalping Steem/USDT

Scalping is fast pace trading strategy that rely on technical indicators to help us to make quick decisions in market. When scalping the in Steem/USDT pair, use the combination of indicator can enhance the accuracy of your entry and exit.

One widely use tool is a Relative Strength Index (RSI). RSI measure the speed and change of price movement on the scale of 0 to 100. In scalping strategy, an RSI value above 70 can show us that the market is overbought, suggesting potential reversal and selling point. Alternatively, an RSI below 30 indicate the oversold condition and possible buying opportunity. This quick moves help to scalpers identify short term momentum shifts.

Another valuable indicator is Moving Average Convergence Divergence (MACD). MACD compare two moving averages to detect change in the market trend. A crossover of MACD line over the signal line can indicate the bullish shift, while downward crossover can be suggest the bearish move. This can particularly helpful for scalper who need to react small price fluctuation.

Bollinger Bands are also good for scalping as it highlight market volatility. The bands of this widen when market is volatile and contract during period of low volatility. When price touch the lower band, it can give signal of oversold condition and buying opportunity; touching the upper band might show that the asset is overbought at that time and ready for sell.

In the last, Moving Averages, such like 20 period and 50 period averages, help us smoothly the price data to show the overall trend and it's direction. It can act as dynamic support and resistance level, provide to scalpers in timing their trades.

By combining all indicators as RSI, MACD, Bollinger Bands, and Moving Averages. Trader can form the more complete picture of market condition. This amazing approach enable more inform and timely scalping decision in the Steem/USDT pair.

Question 3: Developing a Scalping Strategy

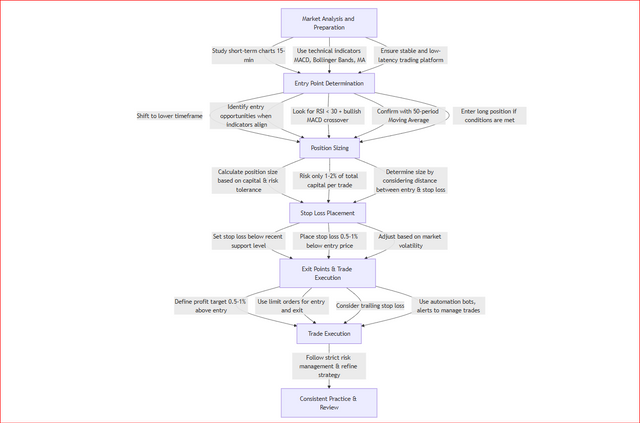

Scalping is the fast growing trading strategy that rely on quick decision to capture the small price movement Below is step by step scalping strategy design for Steem/USDT pair, describing key element like entry and exit points, position the size, and stoploss placement.

Step 1: Market Analysis and Preparation

Begin by studying short term charts like 15 minute to understand the current market trend and structure. Use technical indicators such as, MACD, Bollinger Bands, and moving average to capture the momentum and volatility. A stable and low latency trading platform is important for executing to rapid trades.

Step 2: Entry Point Determination

Shifting to the lower timeframe ,identify entry opportunity when indicator align and find suitable candlestick pattern. Look for RSI below to 30, suggest the oversold condition, couple with bullish MACD crossover. When moving average like the 50-period MA, it show a signal good for entry point. Enter long position when this conditions are meet, ensure that market environment supports quick reversal.

Step 3: Position Sizing

Calculate appropriate position size base on trading capital and risk tolerance. It is famous and advisable to risk only 1 to 2% of total capital per trade. This approach helps control the risk of rapid loss. Determine the size by consider the distance between the entry point and stoploss level, ensure the potential losses remains within acceptable limits.

Step 4: Stop Loss Placement

Set stoploss just below the recent support level or below buffer space. This protect the trade from sudden movements. A common practice is place the stoploss 0.5 to 1% below the entry price, adjust based on current market volatility.

Step 5: Exit Points and Trade Execution

Defining profit target at around 0.5-1% above your entry position and place on next area of interest. Using limit order for both entry and exit to minimize delay. Consider trailing stops loss as the price move in our favorably to secure profits. Automation through trading bots and pre set alert can help manage multiple trades perfectly, ensure capture small gain quickly without missing opportunity.

By following this steps and maintaining strict discipline in risk management, traders can effectively scalp the Steem/USDT market while executing multiple trades throughout the day. Consistent practice and market review are key to refining your scalping strategy over time. Here is my scalp trade on Steem/USDT and I am in the profit by analyze my strategy everyone can earn profit.

Question 4: Risk Management in Scalping

As we know that scalping is high frequency trading strategy but it come with several risk that need to manage carefully and with stong management, especially when we trade with the Steem/USDT pair.

One of the most major risk in scalping is the market volatility. Price can change quickly, and sometimes within seconds, which can be show as a result in significant loss if market move against our decision. To handle this, trader should set tight stoploss order. A stoploss help to limit loss by automatically closing the position when the price reach a predefined level. It is crucial and important to place stop-loss orders at below logical support and resistance levels base on technical analysis.

Another risk factor is leverage. Many traders use high leverage to amplify their position, but this also magnify losses. It is important to use leverage conservatively, only take risk with small percentage of your total capital as the famous rule is use the 1-2% per trade. By reducing the amount of leverage, you can reduce the risk of rapid loss and avoid liquidation risk. Liquidation happens when the loss on leverage position exceed your account margin, force the platform to close your position in the loss. To avoid the liquidation risk, we always monitor our margin level closely and adjust position sizes accordingly.

Position sizing is also critical aspect of the risk management. Trading with the too large position can expose the outsized risk, especially in market as volatile as crypto. Instead of this, calculate appropriate size of trade base on the total capital and the distance between entry point and stoploss level. This method ensure that even if trade goes against the decision side, the loss remain within the acceptable range.

Trader should mindful of transaction fee and slippage. Frequent trading can accumulate fee that eat into your profits, so choose a platform with low fees and high liquidity have impotance for trader. High liquidity help to ensure that orders are fill quickly at expected price, reduce the risk of slippage where trader receive worse price than anticipated.

In my opinion, having the right technology is also crucial for successful scalping. Trader should invest in fast, reliable internet connection and quick response device, such as powerful computer and smartphone. A robotic base technical setup ensure that order are execute almost instantly, reduce the risk of slippage and delays that can lead to miss opportunities and increase loss. In the fast paced world of scalping in trading, even the slight delay can costly, so the dependable system is crutial for maintaining the edge.

I think that discipline and continuous monitoring are key of success. Stick to trading plan, avoid emotional decision in scalping, and regularly review performance to adjust strategy as needed with time. By manage the leverage, carefully sizing the positions, and using protective stoploss order, We can mitigate loss and reduce the risks associated with scalping the Steem/USDT pair.

Question 5: Real-World Scalping Case Study

In hypothetical scalping scenario with Steem/USDT pair, a person begin by closely monitor the short term chart using 1-minute and 5-minute intervals, to capture the rapid price movement. Early in trading session, many technical indicators such RSI, MACD, and Bollinger Bands suggest that the Steem is nearing the oversold condition. like this, the RSI is around the 30 and bullish MACD crossover occur, indicate the potential upward bounce of price. Confident in the signals, the Fareed enter a long position with tight stoploss place just below to recent support level to protect the sudden market reversals.

In this ideal situation, the market quickly recover. The price bounce off the support level, and the Fareed secures a small profit by closing position once the price reach at target gain, say around the 0.5to1%. This small gain is then compound over the multiple trades during the session. The Fareed’s approach is rely disciplined, he's relying on precise execution, low transaction fees, and minimal slippage. A fast internet connection and a quick response device ensure that orders are execute quickly, which is essential for strategy that depend on minute price changes.

But, the market does not always behave same. In an other scenario, some factors such as unexpected news and heigh volatility can cause the rapid price drop immediately after the entry. Here is other trader, Ahsan’s pre set stoploss is trigger, limiting the loss to small percentage of trading capital. This experience force key takeaway, difficult and proper risk management is important. Even with robust technical strategy, the unpredictable scenario of crypto markets which means that loss cut measure must be in place.

Another aspect observe in both scenarios is a need for adaptability. When market exhibit low liquidity and an unusually wide bid ask spread, the trader can decide to reducing the position size and temporarily pause trading. This steps helps to avoid slippage and minimize the risk of over exposure.

Overall, this study highlight two side of scalping, the potential for steady, and small profits during in favorable condition, and the critical importance of risk management during the downtrends. Success in scalping of Steem/USDT pair rely on a discipline trading plan, real time market analysis, effective execution technology, and ability to adjust the strategy in response to change the market conditions.

Now I invite my friends @chant, @heriadi, @artist1111, @josepha and @suboohi to participate in this contest.

Regards,

Faran Nabeel

Cc, @kouba01

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit